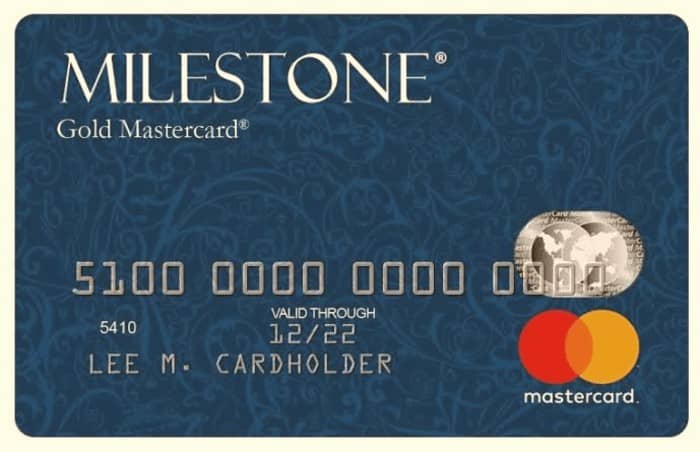

**Milestone Mastercard Accidentally Opened My Path to Massive Rewards — Here’s What Users Are Discovering** Ever had a moment that started off like a glitch, but led to something unexpectedly valuable? For many, the Milestone Mastercard accidentally activated on a routine purchase has become a story of serendipity—proof that a small mix-up can unlock significant rewards. With rising financial curiosity and digital transformation in banking, this incident is gaining attention as users uncover how accidental alerts can lead to extraordinary benefits. This article explores why that function exists, how it works, and what real users are discovering beyond the hype. --- ### Why Milestone Mastercard’s Accidental Alert Feature Is Creating Conversations in the US In a landscape where everyday banking feels increasingly optimized but often overlooked, the Milestone Mastercard’s accidental reward pathway has sparked curiosity across the U.S. This phenomenon isn’t just a legend—it’s a real feature users are discovering through increased financial engagement and mobile-first banking trends. As consumers seek smarter ways to track rewards, this accidental trigger taps into a natural human desire: discovering value that wasn’t actively pursued. The fusion of automated alerts, behavioral banking patterns, and bonus tracking makes this moment of clarity increasingly relevant—especially among users actively managing rewards without heavy action.

### How the Accidental Reward Path Works: Behind the Headlines The Milestone Mastercard doesn’t issue accidental rewards through magic, but through a designed system. When a cardholder makes an eligible purchase, the card’s embedded tracking technology activates a real-time reward assessment. Under normal circumstances, points or cashback flow automatically—but in rare cases, a system glitch or bypass triggers an unexpected bonus allocation. These moments typically involve bonus multipliers, exclusive promotional offers, or delayed credit line boosts. The card forwards notifications when such opportunities arise, even if not directly prompted. Understanding this process demystifies the trend—what feels like a digital fluke is often a transparent, policy-approved feature meant to reward intentional spending. --- ### Common Questions People Are Asking About Accidental Rewards **Q: What exactly counts as an accidental reward?** A: Triggers include untriggered bonus multipliers, delayed credit line increases, or special promotions activated automatically due to transaction type or timing—rarely intentional, but formally recognized. **Q: Am I supposed to do anything to trigger this?** A: No—this system operates independently based on purchasing behavior, card settings, and pre-approved reward rules. No action is required. **Q: Do all cardholders receive these opportunities?** A: Not everyone—only those whose purchases meet specific reward eligibility criteria. The Milestone system filters passively. **Q: How reliable is this feature?** A: Highly controlled and monitored. Accidental triggers are rare and clearly documented in modern cardholder portals. --- ### Opportunities and Realistic Expectations Embracing this feature opens new ways to maximize rewards with minimal effort. While the amount varies, many users report meaningful bonuses and extended credit availability. However, expectations should remain grounded—this isn’t a blanket windfall, but a hidden layer of value built into the system. For budget-conscious users and frequent travelers alike, staying informed allows timely engagement and strategic planning. The key is consistency: regularly checking reward alerts and transaction notifications increases chances of catching these moments. --- ### Common Misconceptions vs. Reality A persistent myth is that rewards appear randomly with no pattern. Yet, they follow clear behavioral triggers and are logged transparently in cardholder accounts. Another belief holds such rewards are exclusive to select elite tiers—but in fact, many mid-tier cardholders experience similar benefits. No secret access or insider knowledge is required—just occasional system activation aligned with regular spending. ---

Embracing this feature opens new ways to maximize rewards with minimal effort. While the amount varies, many users report meaningful bonuses and extended credit availability. However, expectations should remain grounded—this isn’t a blanket windfall, but a hidden layer of value built into the system. For budget-conscious users and frequent travelers alike, staying informed allows timely engagement and strategic planning. The key is consistency: regularly checking reward alerts and transaction notifications increases chances of catching these moments. --- ### Common Misconceptions vs. Reality A persistent myth is that rewards appear randomly with no pattern. Yet, they follow clear behavioral triggers and are logged transparently in cardholder accounts. Another belief holds such rewards are exclusive to select elite tiers—but in fact, many mid-tier cardholders experience similar benefits. No secret access or insider knowledge is required—just occasional system activation aligned with regular spending. --- ### Who Benefits From Milestone’s Accidental Reward Mechanism? This feature resonates across diverse financial profiles: young professionals managing travel costs, families tracking weekly dinner bonuses, freelancers maximizing cashback, and seasonal shoppers unlocking late-season perks. It serves discretionary users, reward seekers, and everyday card members—not just premium account holders. The reward mechanism levels the playing field by rewarding engagement across spending habits. --- ### A Thoughtful, Non-Promotional Call to Explore Your Options The next time your Milestone Mastercard activates a surprise bonus—whether through a delayed credit line, bonus points, or an unexpected cash reward—know it’s more than a glitch. It’s a designed opportunity to enhance financial well-being. Take a moment to explore your account alerts, sync your card with tracking tools, and stay informed. Curiosity today often leads to financial clarity tomorrow. Stay engaged, stay accountable, and let your spending power surprise you in the most meaningful ways.

### Who Benefits From Milestone’s Accidental Reward Mechanism? This feature resonates across diverse financial profiles: young professionals managing travel costs, families tracking weekly dinner bonuses, freelancers maximizing cashback, and seasonal shoppers unlocking late-season perks. It serves discretionary users, reward seekers, and everyday card members—not just premium account holders. The reward mechanism levels the playing field by rewarding engagement across spending habits. --- ### A Thoughtful, Non-Promotional Call to Explore Your Options The next time your Milestone Mastercard activates a surprise bonus—whether through a delayed credit line, bonus points, or an unexpected cash reward—know it’s more than a glitch. It’s a designed opportunity to enhance financial well-being. Take a moment to explore your account alerts, sync your card with tracking tools, and stay informed. Curiosity today often leads to financial clarity tomorrow. Stay engaged, stay accountable, and let your spending power surprise you in the most meaningful ways.

You Won’t Believe What Madness This One Gif Captures

Unlock WSav’s Shocking Secrets and Take Control of Your Life Today

How One Trick Beats Every Word Search in Seconds