**Understanding Mean Absolute Deviation: Why It’s Reshaping Financial and Data Awareness in the US** Why is mean absolute deviation capturing quiet yet meaningful attention across business, finance, and personal planning circles? This statistical tool, once confined to academic circles, is now a quietly influential part of how people understand risk, variability, and reliability—especially in an era defined by data-driven decisions. For curious readers navigating markets, budgets, or long-term planning, mean absolute deviation offers a simple yet powerful way to measure uncertainty. As economic fluctuations and data transparency grow in public focus, this metric is emerging not as jargon, but as a practical lens for making clearer choices. ### Why Mean Absolute Deviation Is Rising in Public Discourse Across the United States, uncertainty shapes daily decisions—whether in personal finance, investing, insurance, or supply chain planning. In this climate, consumers and professionals increasingly seek tools to quantify risk beyond simple averages. Mean absolute deviation fills a critical gap: it captures how much actual values diverge from a central estimate, without distorting impact with oversimplification. Rising concerns over market volatility, inflation unpredictability, and portfolio performance have shifted attention toward metrics that reflect true variability—not just trends or averages. The measurable clarity mean absolute deviation delivers resonates with a mobile-first audience hungry for understanding. No complex models or exclusive software is needed. Instead, it offers an intuitive framework that supports smarter choices, from retirement savings to inventory management. Its quiet rise reflects a broader cultural shift toward data literacy and risk awareness, especially among users comparing platforms, investment tools, or business outcomes.

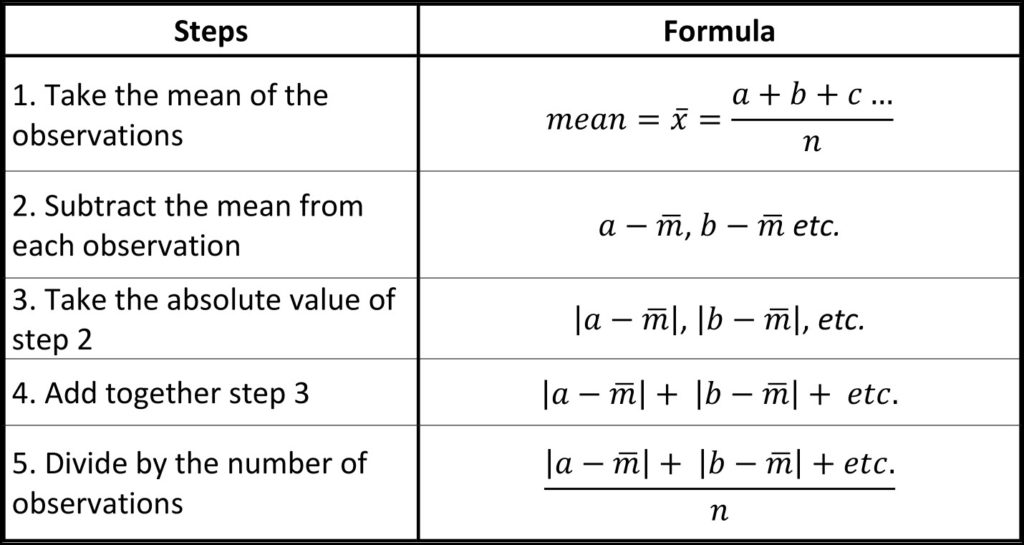

Mean absolute deviation measures the average distance between each data point and a central value—typically the mean. In simple terms, it tells you how much actual outcomes typically vary from a given figure. Unlike standard deviation, which squares deviations and amplifies large differences, mean absolute deviation reflects variability in a straightforward, easily digestible way. Formally, for a dataset of values, the mean absolute deviation is calculated by averaging the absolute differences between each value and the mean. The result is a single number representing average spread—ideal for explaining risk, consistency, or reliability without overwhelming technical detail. This clarity makes it a trusted method across fields requiring transparent quantification. For example, when evaluating investment returns, mean absolute deviation quantifies volatility in terms users can grasp without specialized training. It distinguishes when variances are mild or meaningful, supporting informed, calculated decisions. ### Common Questions People Have About Mean Absolute Deviation **Q: Isn’t mean absolute deviation the same as standard deviation?** Mean absolute deviation differences lie in calculation and sensitivity. Standard deviation squares deviations, emphasizing outliers, while mean absolute deviation uses direct averages, offering a less volatile, more intuitive measure. Both serve distinct communicative purposes. **Q: How do I apply mean absolute deviation in real life?** It applies wherever risk or uncertainty matters—budgeting, asset performance tracking, quality control, or personal goal setting. By revealing inherent fluctuations around averages, it helps you anticipate realistic outcomes and plan more resiliently. **Q: Can mean absolute deviation be negative?** No. Since it measures absolute differences, all results are non-negative. This policy ensures clear, trustworthy data interpretation. **Q: How is mean absolute deviation changing how users assess risk?** By making variability tangible and understandable, it shifts focus from single-point forecasts to realistic expectations, empowering users to evaluate options with greater precision. ### Opportunities and Considerations **Pros** - Simple yet powerful visualization of uncertainty - Enhances data literacy and informed decision-making - Applicable across personal, professional, and financial domains - Builds trust by presenting relative variance clearly **Cons** - Requires accurate, representative data for reliability - May underestimate rare extreme events (unlike supplementary risk tools) - Misinterpretation can occur without proper context To maximize value, pair mean absolute deviation with complementary analysis and context. Use it as part of a broader risk assessment—not an isolated metric. ### What Mean Absolute Deviation Might Mean for Different Users In personal finance, it helps assess investment volatility or monthly budget reliability. For small businesses, it supports forecasting demand with clearer risk visibility. Investors use it to compare portfolio consistency. Across education and healthcare planning, it informs long-term reliability estimates. Its neutrality and clarity make it suitable for diverse, data-sensitive audiences seeking sensible, transparent insights. ### Gentle Nudges: Soft CTA Without Hard Selling For those navigating complex data landscapes, consider a soft CTA that invites exploration: Explore how mean absolute deviation can refine your risk management strategy—discover tools and insights that bring clarity to uncertainty. Stay informed: regular updates on risk metrics continue shaping smarter decisions across life’s key transitions. Your next step might be click-free, but it’s grounded in practical understanding.

To maximize value, pair mean absolute deviation with complementary analysis and context. Use it as part of a broader risk assessment—not an isolated metric. ### What Mean Absolute Deviation Might Mean for Different Users In personal finance, it helps assess investment volatility or monthly budget reliability. For small businesses, it supports forecasting demand with clearer risk visibility. Investors use it to compare portfolio consistency. Across education and healthcare planning, it informs long-term reliability estimates. Its neutrality and clarity make it suitable for diverse, data-sensitive audiences seeking sensible, transparent insights. ### Gentle Nudges: Soft CTA Without Hard Selling For those navigating complex data landscapes, consider a soft CTA that invites exploration: Explore how mean absolute deviation can refine your risk management strategy—discover tools and insights that bring clarity to uncertainty. Stay informed: regular updates on risk metrics continue shaping smarter decisions across life’s key transitions. Your next step might be click-free, but it’s grounded in practical understanding. ### Conclusion Mean absolute deviation is more than a statistical term—it’s a bridge between raw data and real-world clarity. In a US market increasingly focused on transparency, resilience, and informed choice, this simple yet powerful metric supports sharper understanding of variability and risk. By grounding abstract uncertainty in measurable terms, it empowers users across personal, financial, and professional spheres to build stronger, more confident decisions. As data shapes every decision, mean absolute deviation stands as a quiet but vital tool for clearer, more intentional choices.

### Conclusion Mean absolute deviation is more than a statistical term—it’s a bridge between raw data and real-world clarity. In a US market increasingly focused on transparency, resilience, and informed choice, this simple yet powerful metric supports sharper understanding of variability and risk. By grounding abstract uncertainty in measurable terms, it empowers users across personal, financial, and professional spheres to build stronger, more confident decisions. As data shapes every decision, mean absolute deviation stands as a quiet but vital tool for clearer, more intentional choices.

Unlock the Mystery Behind Impossible YTS Quality You’ve Never Seen Before!

ymax That Shocked the Gaming World Overnight

You Won’t Believe What This Xylophone Does When It Attacks Your Senses