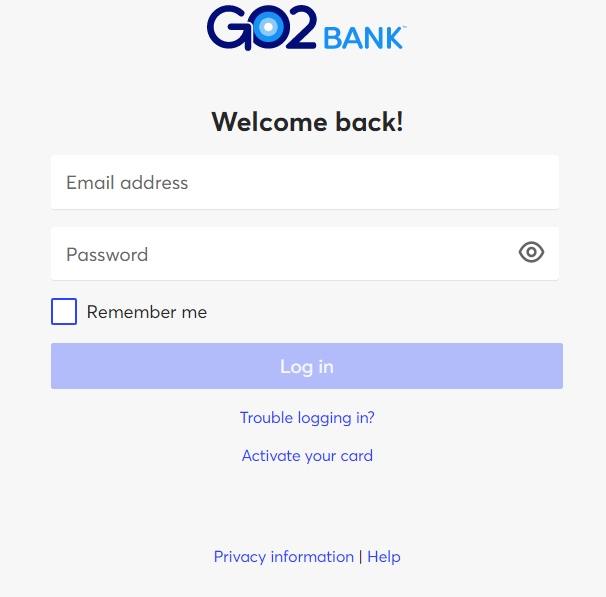

**Go2 Bank Login? What If Your Credentials Were Taken Tonight?** In an era where digital security is under constant scrutiny, more users are quietly worrying—what if my Go2 Bank credentials were compromised tonight? With data breaches rising and cyber threats evolving daily, asking, *“What if my login was stolen?”* is no longer unusual. As financial technology grows more integral to everyday life, safeguarding access isn’t just a technical step—it’s a routine concern for millions across the U.S. Amid growing awareness, discussions around account security are shifting from rare incidents to shared priorities. The rise of identity theft prevention tools, multi-factor authentication adoption, and financial literacy campaigns highlight a national conversation: users want control over their digital trust. Go2 Bank’s login security protocol emerges in this context—not just as a safety feature, but as a responsive tool users increasingly expect. **Why Go2 Bank Login? What If Your Credentials Were Taken Tonight? Is Gaining Urban Attention** Recent spikes in secure login alerts and identity monitoring reports confirm rising awareness. While Go2 Bank isn’t widely publicized, the question reflects its role in a broader cultural shift: accountability online matters. When users ask, *“What if my credentials were taken tonight?*” they’re not just self-protecting—they’re seeking clarity on a real risk. Behind this query lies a growing demand for transparency, immediate response options, and peace of mind in digital banking. **How Go2 Bank Login? What If Your Credentials Were Taken Tonight? Actually Works** Go2 Bank’s system is engineered to detect suspicious activity and support rapid response. When login anomalies trigger alerts, the platform implements layered verification—often automatically—while flagging high-risk sessions. Customers receive clear notifications, guided through verification steps with minimal disruption. This process, built on secure access design and proactive monitoring, helps prevent unauthorized use and restores user control efficiently. The system balances urgency with user-friendliness, supporting real-time protection without compromising trust. **Common Questions People Have About Go2 Bank Login? What If Your Credentials Were Taken Tonight?**

**What happens if my Go2 login is compromised?** If suspicious activity is detected, Go2 triggers instant alerts to users, prompting verification steps to secure or re-login—often without full account suspension. This prevents unauthorized transactions while preserving user access. **Do I need to change my password daily?** While strong, unique passwords remain essential. Go2 encourages using password managers and two-factor authentication for layered defense—without requiring daily changes to avoid friction. **Will my data be exposed if someone hacked my Go2 login?** No accounts are fully exposed without detection. Go2’s protocols isolate breaches to active sessions, minimizing impact while alerting users and offering immediate steps to secure their access. **Is it safe to trust online banking security tools?** Yes—when backed by industry security standards, encryption, and transparent incident response policies. Go2’s commitment to compliance and user control builds institutional trust. **What protects my Go2 Bank login more—strong password or multi-factor authentication?** While strong passwords are necessary, multi-factor authentication provides critical additional protection. Even if passwords are briefly accessed, MFA blocks remote access, making unauthorized entry far harder. **How frequent are credential-based breaches in banking?** Phishing and data leaks remain common, but banks like Go2 continuously upgrade security layers—including behavioral monitoring, automated threat alerts, and instant account locking—to reduce risk. **Who Should Consider Taking This Security Question Seriously?** Anyone using Go2 Bank for daily transactions, managing finances, or storing sensitive financial information benefits from treating login security seriously. The “What if?” mindset today is proactive digital hygiene—essential in a threat-laden landscape. **Final Thoughts: Awareness Builds Confidence** Navigating digital threats isn’t personal failure—it’s part of modern financial life. The growing frequency of security alerts signals a shift toward smarter, more resilient habits. For Go2 users: asking *“What if my credentials were taken?”* today means embracing proactive protection. Stay informed, trust your bank’s safeguards, and stay one step ahead with awareness. In a digital world where vigilance matters, informed users are empowered users—whether accessing Go2 Bank or managing any online platform.

Shocking Revelations From Yonutz That Will Leave You Speechless

They Said You Met Me, But What They Said Was More Than You Were Ready For Eternity

Two Dollar Magic Habit That Changes Everything Most People Miss